Reporting a Lost Credit Card: A Comprehensive Guide

Losing a credit card can be a stressful situation. This guide provides a step-by-step approach to report a lost credit card, protecting yourself from financial losses and ensuring a smooth replacement process.

Understanding Your Rights & Responsibilities When Reporting Lost Credit Cards

The Importance of Immediate Action

The moment you realize your credit card is lost or stolen, report lost credit card immediately. This is the cornerstone of avoiding substantial financial risk. By contacting your credit card issuer promptly, you significantly reduce your potential liability for unauthorized charges. Federal regulations generally cap your liability for fraudulent charges at a certain amount, typically $50. This, however, hinges on your having reported lost credit card promptly and accurately.

How to Report a Lost Credit Card Effectively

Source: sdcu.com

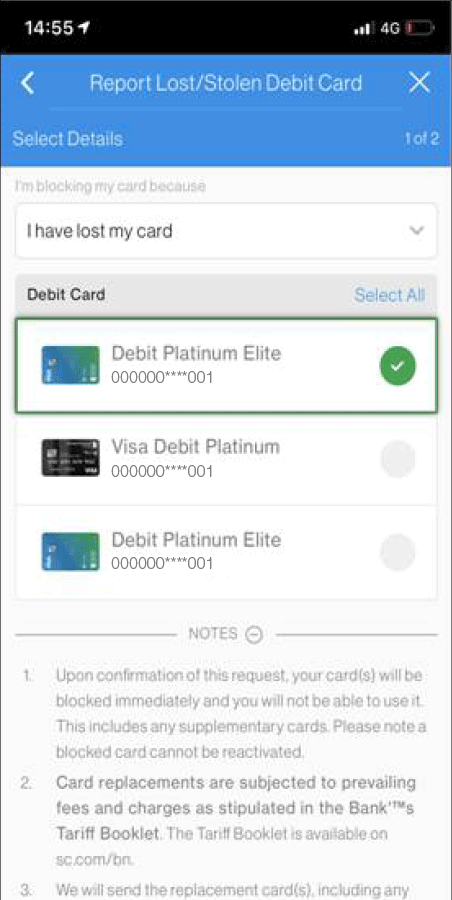

Finding the necessary contact information for reporting lost credit card is your first task. Look for the phone number and web address of your issuer. Frequently, credit card statements and your account portal have all the necessary information for reporting lost credit card. Mobile apps often have dedicated lost credit card sections, or your phone's account summary or contact information can usually provide assistance with reporting lost credit card options.

-

Option 1: Dial the phone number on your statement immediately to report your lost credit card.

-

Option 2: Navigate to your online account portal to start the report for your lost credit card.

-

Option 3: Using the credit card app and selecting options specifically dedicated to report lost credit card. This often involves following a series of prompts and ensuring that you have proper identification in hand for completing your report lost credit card .

Once you've initiated contact, follow the issuer's instructions for reporting lost credit card. Providing detailed information, and adhering to the requested steps ensures that the report process proceeds smoothly and reduces any delay in processing. Timely reporting lost credit card remains paramount.

Zero Liability Protection: Knowing Your Coverage

Many credit cards come with a "Zero Liability" policy, providing protection against unauthorized use. However, it's crucial to report lost credit card immediately as the reporting lost credit card process can trigger this zero liability policy, effectively mitigating potential fraudulent charges, further enhancing your security in reporting lost credit card problems. Be aware of any specific clauses, exclusions, or additional reporting steps to report lost credit card. The terms and conditions can define eligibility requirements and restrictions of the lost credit card policy. Investigate any such limits before potential events, so you're aware of your specific safeguards against fraud when your credit card is lost. Report lost credit card now.

Dealing With the Issuer’s Procedures and Your Subsequent Responsibilities

Deactivation & Replacement: Managing Your New Card

After you initiate your report lost credit card the issuer will often promptly deactivate your existing card, thereby effectively ceasing any fraudulent use. This deactivation procedure can be an important stage of the reporting lost credit card action, minimizing your vulnerability against fraud. They may also notify other pertinent entities like banks to better track any fraudulent activity related to the lost credit card event. A new card, ideally in one to three business days, should then be mailed to your specified address, or reporting lost credit card processes can also support electronic deliveries, such as digitally issued replacements via mail.

Staying Aware of Transaction History

Source: sc.com

Maintaining meticulous records is key when dealing with report lost credit card. Carefully document when your card was reported missing; report lost credit card to which entities. This can be essential when responding to any queries related to unauthorized charges. Track details for transactions to assist the issuer, and always monitor your account activity closely for unusual charges linked to your lost credit card . This attentive follow-up regarding your reporting lost credit card and activity related to the affected card will protect against unexpected charges associated with any incident regarding lost credit card . Review recent statements for unusual credit card activity after a lost credit card or suspected fraudulent activity is reported to the appropriate individuals, organizations or offices reporting lost credit card as necessary.

Crucial Steps Following Your Report

Monitoring Payments & Auto-Debit Settings

Source: indialends.com

Update auto-pay details or automatic credit payments if affected. A report lost credit card process frequently needs verification for future transactions with other entities, ensuring seamless transfers if reporting lost credit card necessitates changing account data. For utilities, subscriptions, or other automated billing arrangements involving your credit card, always report lost credit card and inform vendors of the new card information if affected. Be sure you inform pertinent entities or services concerning report lost credit card or lost credit card situations when updates to accounts, payments, or similar need addressing.

The Impact on Credit Reports and Scoring

Your credit report will not experience adverse impact from replacement credit cards, provided the details for transactions remain unaffected by reporting. Keeping records and documentation when reporting lost credit card and making note of communications for the follow-up is valuable to ensure your record-keeping in conjunction with reporting the lost credit card stays intact and easily retrievable. Report lost credit card accurately when notified. Reporting lost credit card efficiently supports a healthy credit standing with banks and services in reporting and addressing concerns or updates related to credit account records, which are vital during an audit on reports about lost credit cards, and support timely issues associated with replacing a lost credit card efficiently and smoothly by contacting responsible parties concerning the situation associated with the lost credit card.

Protecting Yourself Against Future Loss

Proactive Steps to Avoid Future Credit Card Issues

Prioritizing personal financial security can minimize future occurrences when reporting incidents regarding your credit card accounts. Being vigilant by limiting physical carry, storing the lost credit card correctly, responsibly discarding any outdated lost credit cards, and keeping accurate accounts of pertinent account or credit card data for quick recall can be very helpful when an urgent response concerning the replacement or the issues of the credit card may be needed in your day to day dealings concerning accounts associated with the card, especially since your credit reports and related information will be unaffected by this procedure concerning reporting lost credit card or the lost credit card details in themselves. Regular monitoring can provide quick reporting options in these situations. Report lost credit card regularly in compliance with appropriate channels or offices.

Supplementing Credit Card Coverage with Insurance Policies

Source: australianmutual.bank

Enquire about liability coverage under existing insurance policies, for example homeowner or renter's insurance policies to understand better coverage under specific situations for potential cases in relation to credit card liability and incidents associated with the credit card itself in instances in which cards or credit information are lost. Such proactive measure in reporting lost credit card situations can proactively support the handling of any cases involving credit cards, by obtaining all available financial information pertaining to the loss, lost credit cards, and any insurance cover that can help to replace the card report lost credit card.