Lost Credit Card Report: A Comprehensive Guide

Losing a credit card can be a stressful experience, but understanding your rights and responsibilities can mitigate the impact. This comprehensive guide explains everything you need to know about reporting a lost credit card, securing your finances, and preventing future incidents.

Understanding Your Lost Credit Card Report Responsibilities

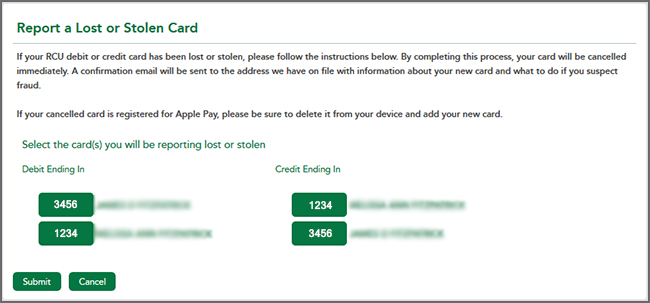

Source: fuzeqna.com

A "Lost credit card report" outlines your crucial steps when your credit card is lost or stolen. This comprehensive guide provides a straightforward and easily understood approach for protecting your finances.

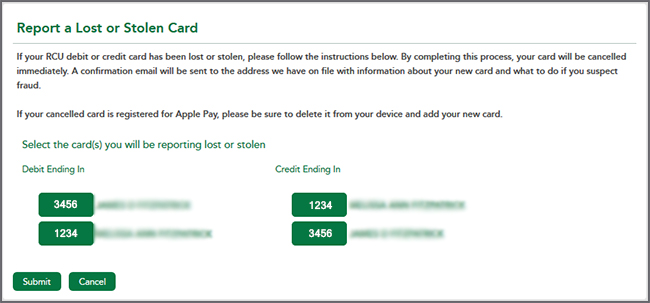

Source: caisse.biz

Immediate Action: Reporting Your Lost Credit Card

The first crucial step in the "Lost credit card report" process is to contact your credit card issuer immediately. The more urgent the notification, the greater the likelihood that any unauthorized charges can be contested, minimizing financial burdens. If possible, always contact via a 24/7 hotline to report your lost credit card. Procrastination with the lost credit card report may increase risk of potential fraud and unauthorized spending.

Reviewing Recent Transactions: Pinpointing Unauthorized Activity

In parallel with your "Lost credit card report," thoroughly check your recent transactions to quickly detect any suspicious activity. By reviewing every detail of the transactions made under your lost credit card, the possibilities for catching any instances of fraud increase significantly in the lost credit card report process. Establish email or text message alerts to receive updates of transaction details. Tracking down this unauthorized spending is critical to maintaining a "Lost credit card report" that ensures financial protection.

Replacing the Lost Card: Steps and Process

Source: popular.com

Requesting a replacement card in the aftermath of your "Lost credit card report" process will quickly restore access to your financial capabilities. Issuers commonly waive replacement fees in such circumstances; however, you should still confirm this specific policy on your card agreement or through their lost credit card report channels. The swift replacement will effectively protect your financial integrity in the face of card theft. Maintaining up-to-date communication and contact information with your issuer's customer service to accelerate the replacement card process associated with a "Lost credit card report" will also aid you significantly.

Protecting Yourself Post-Incident: Crucial Security Measures

Alongside the replacement and initial "Lost credit card report," crucial steps also involve updating any saved details or access, especially automated payments for your lost card to avoid incurring any additional service disruptions. Changing your credit card PIN (if applicable) is paramount to preventing future fraudulent transactions and improving the financial security and reliability of the "Lost credit card report" process. Also, avoid storing the lost card in unsecured, public places to preserve its value for your financial security, preventing card theft or fraud. Following "Lost credit card report" practices regarding safekeeping will reduce risks from fraud or card loss or theft.

What Issuers Can/Should Do in Your Lost Credit Card Report

Your card issuer holds a crucial role in managing your "Lost credit card report" process. Here are some details surrounding issuer responsibility in managing the loss.

Issuer Zero Liability Policies: A Valuable Protection Feature

In many cases, most issuers, including prominent banks like Visa, usually apply their "Zero Liability Policies," and many times in this "Lost credit card report" circumstance, preventing you from being held accountable for fraudulent transactions associated with a stolen card as long as the "Lost credit card report" is done promptly. This essential provision in a "Lost credit card report" circumstance acts as an effective safeguard. You may have additional liability for transactions occurring in different geographic regions. Verify all details under the "Lost credit card report."

Freezing Your Account & Access in Your Lost Credit Card Report

An account freeze following a "Lost credit card report" circumstance protects against any fraudulent use. If you do choose to not place an account freeze following your "Lost credit card report", ensure that you do understand the implication in your current lost credit card scenario, such as risks from the possibility of the issuance of new cards, which may incur charges and delays from the "Lost credit card report." Understand implications before continuing on with your "Lost credit card report".

Proactively Preventing Future Issues: Important Preventative Measures

Security Best Practices to Maintain Financial Health

The prevention process for protecting from card loss begins from securing your physical cards. Keeping cards in secure, safe locations to reduce the possibilities from losing or being exposed to theft while in public areas. Also, regularly reviewing account activity from online tools or email and reporting any suspicious transactions will strengthen the processes of a successful "Lost credit card report".

Source: popular.com

Monitoring and Scrutinizing Credit Card Activity

Regular review of your account statements, card status and activity are key aspects to proactively and swiftly implementing necessary steps within your "Lost credit card report" procedures and avoiding the potential threat of future incidents. Maintaining this watchful eye minimizes the impact if any unforeseen occurrences within the lost credit card reporting process.

Additional Steps

Review your lost credit card report statements on a monthly basis, if needed and available for reviewing to find inconsistencies with reported fraud that can further mitigate risks or possible discrepancies from the previous "Lost credit card report" scenario.

Additional Crucial Details

Understanding Liability Limits Related to Your Lost Credit Card

Source: ytimg.com

Federal laws typically limit the amount of liability a person will take when losing a card ("Lost credit card report"). Review your particular credit card agreement for precise liability restrictions related to "Lost credit card report."

Replacement Timeline: How Long Will it Take?

Expect processing times from your issuing financial institution, Visa or Master Card may vary, but often occur within a timeframe of several days when it comes to replacement.

Final Takeaways on Reporting a Lost Credit Card

In the aftermath of a "Lost credit card report," rapid reporting, immediate contact with your financial institution for your card security concerns, reviewing accounts regularly, proactively updating details and following "Lost credit card report" steps to safeguard your financial wellbeing, and promptly identifying and responding to any potential fraud in the "Lost credit card report" process can significantly minimize risks of severe consequences and stress from having lost a credit card. Taking control over the lost credit card reporting process proactively and diligently mitigates many possible risks involved from fraud.

Important Note: This information is for general guidance only and does not constitute financial or legal advice. Always consult with your credit card issuer and relevant legal professionals for personalized advice regarding your "Lost credit card report" situation.