Lost Credit Card Police Report: A Comprehensive Guide

Source: cityofpsl.com

Losing your credit card can be a stressful experience, potentially leading to financial distress and identity theft. This guide will outline the crucial steps to take when a lost credit card police report becomes necessary, highlighting preventative measures to safeguard yourself and your finances.

Understanding the Urgency: Why a Prompt Lost Credit Card Police Report Matters

The Immediate Action Cycle

Time is of the essence when you realize a credit card is missing. Prompt action, including freezing credit cards, debit cards, and filing a lost credit card police report, drastically minimizes your financial vulnerability to unauthorized transactions. The quicker you act, the less likely you are to face substantial financial burdens. Often, a quick response will yield a substantially smaller liability than waiting, say, a week or more to notify relevant authorities of your lost credit card police report.

Lost Credit Card Police Report vs. Potential Financial Impacts

A lost credit card police report is not a guaranteed method of preventing future use of your card, but it significantly assists you in maintaining control over your accounts if they're ever compromised. By reporting a lost credit card police report promptly, you effectively diminish your financial liability for unauthorized charges – preventing escalating problems that could result in substantial account limitations or penalties if fraudulent transactions occur.

Source: website-files.com

Navigating the Report: Key Steps to Filing a Lost Credit Card Police Report

Reporting the Loss: Your Action Plan

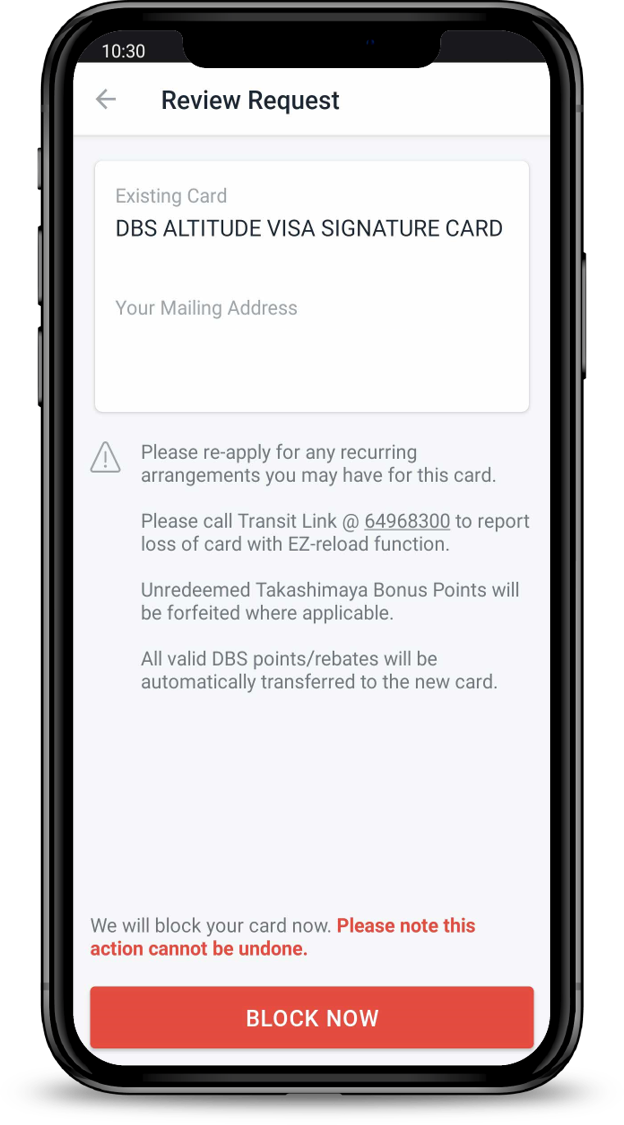

- Secure your Information: The primary aspect of this critical first step is to contact your financial institution—your credit card provider and the bank (or any bank(s) associated with the card's use) – and immediately request that all associated cards and your accounts are frozen or placed on immediate hold to prevent additional loss. This includes promptly notifying them to initiate a replacement credit card so that access is fully deactivated from a lost credit card police report.

- Formal Police Action: Report your missing credit card or lost credit card police report with the local law enforcement authority for their lost credit card police report system. Having a police report in writing can provide significant documentation, should issues arise.

Documentation's Crucial Role in Handling Lost Credit Cards: A Checklist

Maintain detailed records about lost credit card police reports. Compile crucial data points about your cards, such as the card numbers, expiry dates, and issue locations. This ensures a thorough account of the details needed for efficient processing in initiating procedures for replacing the credit card, whether the missing card involves a single lost credit card police report or several credit cards involved in multiple lost credit card police reports.

Proactive Steps to Prevent Further Trouble: Addressing Identity Theft after Lost Credit Card Police Reports

.jpg)

Source: wikimedia.org

Freezing Credit Reports, Actively Combatting Identity Theft

Source: pirg.org

Implementing credit freezes for credit cards or financial accounts impacted by a lost credit card police report is vital for combating potential identity theft. These freezing strategies ensure the safety of your personal information. Utilizing additional fraud alerts through these actions will effectively safeguard your financial position and support the efficacy of the credit protection plans and security measures designed and put in place through filing a lost credit card police report.

How To Track Fraud Alert Updates & Access

Source: com.sg

Staying abreast of your account activity and freezing options offered through various credit bureaus and financial institutions following the filing of a lost credit card police report is also essential. Check frequently for suspicious activity on any linked financial statements. Having these mechanisms in place provides important visibility into account activities that should occur within a normal timeframe. Utilizing systems from recognized and respected bureaus can assure accuracy in fraud notification, further mitigating risk.

Checking Accounts and Lost Credit Card Police Reports

Experian offers an integrated approach for identity theft protection and for helping manage your various accounts by freezing certain credit cards that will allow for secure updates within a variety of applications when a lost credit card police report has occurred.

The Ongoing Battle: Post-Report Actions, Ongoing Security Measures, and Credit Building

Maintaining an Active Ledger of Essential Details (Credit Card & Others)

Keep records of all your credit card information, especially those connected to a lost credit card police report, such as the card numbers and any related access data and locations for potential card issuance (if previously stored somewhere specific) and dates related to that lost credit card police report. Storing this information safely in a secured location and periodically reviewing the details assists you in managing accounts, as does keeping current of contact and important identification data.

Utilizing Technology for Better Prevention (Digital Wallets and Enhanced Protection Methods)

Consider using digital wallets or card storage apps that offer additional layers of security when you're handling and processing a lost credit card police report. This practice may provide the additional protective measure(s) of additional account verification before approval (as a new measure of preventing fraudulent transactions). They often utilize secure methods like biometrics or multi-factor authentication to minimize risks in the long term, further reinforcing the best practices regarding your security plan for any type of lost credit card police report.

Experian’s Role in Credit Monitoring, Building, and Maintaining Your Financial Strength

Experian is a leading credit reporting agency that assists with establishing a more secure financial strategy when a lost credit card police report is filed. Its various services help keep track of your financial accounts and promote awareness in protecting against unauthorized activity. Keeping up with your accounts and their related information when a lost credit card police report happens is essential, alongside your interactions and engagement with various Experian tools, systems, or procedures. The filing of a lost credit card police report is often a useful event to improve these measures with improved reporting of details or account protections for improved monitoring and vigilance for lost or missing credit cards.

Final Thoughts: Keeping Your Finances Safe Through Careful Record Keeping

Filing a lost credit card police report, along with proactively freezing your credit card(s), serves as the foundation for maintaining control of your accounts after something has been lost. Remember to prioritize updating your records, maintaining accurate documentation about your card's whereabouts, reviewing account details for any potential vulnerabilities, and understanding how each platform for managing credit and financial protection interacts with a lost credit card police report in your favor and your protection. This strategy reduces any further possible effects from fraudulent access or from subsequent misuse related to this report or its related matters related to your lost credit cards and filing procedures for your lost credit card police report. Implementing and utilizing these preventative measures further consolidates your strategy to actively protect yourself from further financial risk through utilizing these strategies and implementing new protections for handling lost credit card police reports.