Stolen Credit Card Report: Your Guide to Protecting Yourself from Fraud

A Comprehensive Overview of Protecting Yourself Against Stolen Credit Cards

A stolen credit card report is crucial to your financial security. This article will guide you through the steps to take if your credit card is stolen and will arm you with knowledge about your rights and responsibilities.

Understanding Your Rights Regarding a Stolen Credit Card Report

This section discusses the legal protections afforded to consumers when a credit card, ATM card, or debit card is stolen.

Federal Protections and Liability for Unauthorized Charges

The Federal Trade Commission (FTC) is committed to safeguarding consumers like you. A stolen credit card report filed with the issuing institution provides federal protection against liability for unauthorized charges. The exact amount you could be held liable for varies considerably, depending on the timing of your report and the transaction timing relative to the card being reported as lost or stolen in the stolen credit card report process.

Time Limits and Liability Amounts

Liability for unauthorized charges depends heavily on when your lost credit card or similar device was reported as lost, and thus included in the stolen credit card report. In most instances, a stolen credit card report filed within two business days limits your liability to a maximum of $50.

This is the core tenet in protecting yourself, filing a stolen credit card report, as it protects you financially from potentially large sums of unauthorized debt. The limits often vary depending on when the issuing bank was notified (included in the stolen credit card report process). These timelines in relation to unauthorized charges within your stolen credit card report often differ from debit card vs. credit card or from various states. Always confirm your financial institution's reporting guidelines for lost credit cards and keep a thorough record to substantiate your stolen credit card report filings with your institution's policy.

However, filing a stolen credit card report late – meaning more than two business days after discovering the loss – might subject you to greater financial responsibility, especially if the transaction is still processed relatively close to when the card was reported missing to the card's issuing bank within the stolen credit card report context. Some factors to consider within the stolen credit card report context are:

Immediate Actions for Protection of Funds

Reporting a stolen credit card to your issuing financial institution within 2 business days, while actively engaged in your stolen credit card report filing and process, is absolutely critical to the security of your accounts. A delayed stolen credit card report can substantially affect your financial recovery plan and lead to losses due to unauthorized purchases after the loss was noticed and reported.

The earlier a stolen credit card report is submitted in an accurate form, the lower the chances of being responsible for fraud and financial issues that stem from credit card losses.

Consequences of Delay in Filing the Stolen Credit Card Report

As stated earlier, delayed reporting of a stolen credit card report often dramatically impacts potential liabilities on a case by case basis. Factors, like the method of notice used for the stolen credit card report (a formal stolen credit card report filing vs a less documented notice of loss to your bank or financial institution), determine the limits to financial responsibilities if an unauthorized transaction or activity were incurred after the stolen credit card was reported.

Steps to Reduce Your Responsibility After a Loss in Your Stolen Credit Card Report Context

Within the stolen credit card report context, filing an immediate stolen credit card report could potentially significantly lessen or mitigate responsibility from liability of financial damages incurred after the notice/reporting process for the stolen credit card. The time frame to lessen liability is often in a narrow window to maintain favorable standing on unauthorized transactions, charges or account activity in cases where your credit card is stolen and reported via stolen credit card report processes.

Understanding Common Scams Related to Stolen Credit Card Reports

The FTC frequently warns consumers about scams involving so-called "credit card loss protection insurance". This particular type of fraudulent operation capitalizes on financial anxieties concerning stolen credit card reports, to falsely and deceptively propose that consumers pay for false claims/compensation with insurance.

Be wary of unsolicited offers to obtain stolen credit card report services. Genuine financial institutions do not make such offers and there are no special reporting programs for stolen credit card reports that involve compensation. Be mindful, your bank's security department should address fraudulent activity related to your stolen credit card report.

How To File a Stolen Credit Card Report

This section contains actionable instructions for individuals concerned about credit card loss or other financial fraud associated with a lost or stolen credit card.

Reporting Your Stolen Credit Card

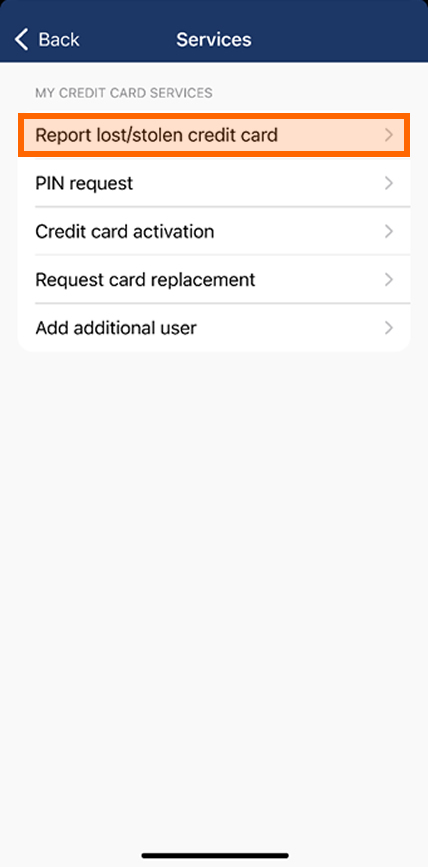

Source: popular.com

Reporting a stolen credit card or any fraudulent activity related to your credit cards, ATM cards or debit cards is crucial in the timely filing process associated with the stolen credit card report process. A timely and proactive stolen credit card report could limit your financial liabilities if unauthorized charges or activity do occur on accounts after the loss has occurred. Contact your card issuer (your bank/financial institution, if the stolen card belongs to you, e.g) as soon as possible after discovering your card has been compromised. It is in the lost or stolen credit card report to report a possible compromise/theft as soon as reasonably possible if you detect unauthorized activity. A formal process may need to be followed regarding the loss, e.g. your financial institution will likely guide you towards the process for documenting loss and possible stolen credit card report process and options as needed to be able to move forward and file your claim to recover potential lost funds or assets.

Documentation of Communication is Important

Maintain detailed records of all communication, conversations, and actions related to reporting your stolen credit card report. Keep copies of correspondence and notes of telephone conversations from filing the initial report regarding your lost or stolen card and record everything. Be sure the stolen credit card report form or any written documents involved in the process or from correspondence during the report process are saved and kept in an easily retrievable, secure location. Be organized with the information in order to track progress made on your behalf with the report filed under your name. Always carefully check communications, documentation (which include your statements in writing to notify and make a report for your missing or stolen card), and ensure the forms associated with your lost credit card filing in the form of a "stolen credit card report". This should confirm your card was indeed reported.

Avoiding Additional Losses & Steps Towards Security

Immediately limit potential losses from fraudulent or unauthorized activities and protect the accounts related to the financial issues stemming from your stolen card. Monitor your accounts daily or weekly to catch any unauthorized activity related to accounts compromised/stolen from the lost or stolen card you reported. Using a security tool to look for any suspicious patterns from any potential or real accounts in compromise is wise practice for the accounts affiliated with stolen cards to limit the overall possible damages to your personal or business interests, to both financial and other. Use multi-factor authentication and store financial and other private information in a secure manner and limit public disclosure. Always take your physical cards, credit, debit and ATM with extreme care in public areas. By protecting physical credit card material/access, your physical property from fraud, the risk of losses of financial assets and losses will likely be minimized. All possible precautions you can employ to make your overall activities or plans surrounding accounts and transactions relating to compromised financial documents secure are essential.

Maintaining Secure Accounts in Order to Minimise Stolen Credit Card Losses

A crucial part of responsible financial activity after discovering a lost/stolen credit card in your lost credit card report is protecting other, remaining financial documents or resources, e.g., by taking action to securely handle other or potentially affected credit card/debit card account numbers and balances after noticing that an account has potentially been lost/compromised.

Preventative Steps

Consider regularly monitoring all financial accounts through either logging in periodically to account or utilizing tools which will notify or alert you to potential threats to your finances from fraudulent and/or other illicit and potentially illegal activities to proactively take the necessary action related to securing account information after noticing potential compromise. In cases with theft or unauthorized actions of a compromised account, a critical preventive step for the stolen credit card report should always consider using multi-factor authentication if available, especially since accounts or compromised cards have become reported in a timely stolen credit card report in order to maintain as high levels of security to lessen losses in the case where loss of the stolen credit card report occurs.

Important Note: Always remember to contact the issuing institution when filing a stolen credit card report immediately in cases involving credit card or other financial document theft or compromise. Timely filing your stolen credit card report is key, and this should be made a top priority to help resolve possible or immediate fraudulent financial or account activity related to theft, damage and loss to yourself or other party. You may save significant losses in terms of the amount of time you take and efforts towards making the situation more quickly rectifiable or amendable via legal and administrative actions you are obligated to perform promptly and report any possible or noticed issue.

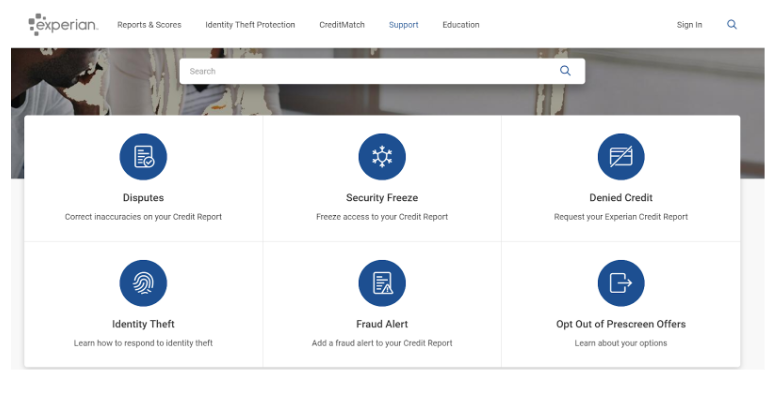

Source: ytimg.com

Additional Questions About a Stolen Credit Card Report

These Q&A addresses several scenarios you may face following loss or stolen card incident:

What if I notice unauthorized activity on my account after reporting a lost credit card?

:max_bytes(150000):strip_icc()/INV-card-recovery-bulletin-4199830-final-800c6a618f4740afa2763bb3f30e6034.jpg)

Source: investopedia.com

Immediately notify your financial institution by making a new "stolen credit card report", following the correct channel associated with your reported activity to prevent liability, to discuss how you should react to your credit cards, bank account and other accounts and funds involved after loss notification.

Source: scoredcredit.com

Are there resources for helping me manage lost and stolen credit card accounts after I file a stolen credit card report?

There are consumer reporting agencies, along with additional guidance provided to the public to resolve and address account compromised due to lost or stolen financial documents like stolen credit cards reported in the stolen credit card report forms or filed via a different process that is usually directed from your bank or financial institution to resolve. This process and resources may or may not help you during recovery and resolution of possible theft or loss based on how promptly the notification is sent, and filed via the process from the bank. There is more resources that could potentially help such as contacting the FTC (Federal Trade Commission) or credit reporting bureau (or any regulatory entity who works towards this matter related to lost/stolen/stolen credit card reports). Contact your bank as well, since the bank, in most instances is directly affiliated with issues/incidents reported in relation to accounts you manage at the bank as an account holder, who reports activity regarding lost credit card events using the stolen credit card report.

How can I proactively secure my credit cards against theft or compromise and minimize losses in general regarding my finances and assets in a financial incident involving compromised stolen accounts via the "stolen credit card report" filing methods

Involve security features available. There are financial security features to take into consideration to limit fraudulent, unauthorized activities/potential liabilities in instances where accounts or credit cards have been reported as lost or stolen credit card or cards, and these types of processes reported to help with resolution and restoration after financial compromise, like those via lost or stolen credit cards/financial documents, including reports to your bank, financial institution and so on and including "stolen credit card reports" processes and associated notifications. Use good digital practices, and take your time with reporting the accounts to secure accounts associated with accounts to further secure accounts. Be proactive in safeguarding yourself in these instances since you can save your losses by making prompt reports through official channels or associated processes used to formally file lost/stolen credit card report notices as reported or detected in accounts owned to that particular holder who made such notices or reported such issues regarding stolen or lost credit card accounts via filing a report under the umbrella category known and referred to as "stolen credit card report." Always make reports as quickly as possible and work directly with your account issuer (your bank, financial institution and etc) promptly. Take physical and cyber precautions as much as possible, to maintain best possible safety measures.